S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Feb, 2023

By Zia Khan

Sector Spotlight: Global Financials is a weekly summary of exclusive banking, financial services and insurance industry news and analysis from S&P Global Market Intelligence.

US and Canada

* Banks face higher hurdles in M&A review as regulators sharpen CRA focus

Regulators' increased focus on Community Reinvestment Act compliance has trickled down to merger review and could explain why bank deals are facing closing delays, industry experts said.

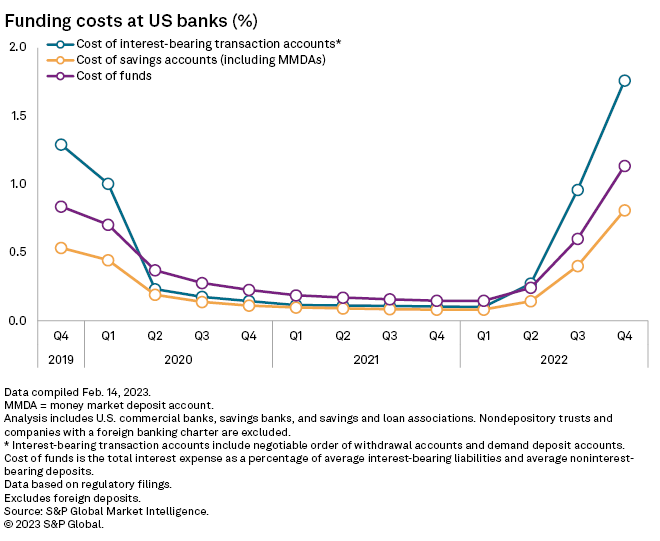

* Deposit outflows worsen as funding costs bite into banks' margin outlook

After three consecutive quarters of runoff, the industry is wrestling with additional declines in 2023 and funding costs that are likely to keep going up even after the Fed pauses interest rate hikes.

|

* Banks intend to 'close the gap' if CFPB slashes credit card late fee income

If the Consumer Financial Protection Bureau's proposed credit card late fee rule passes as is, it will send shockwaves throughout the credit card industry and force banks to change their other fee structures, reward programs and underwriting practices.

* USDF Consortium switching to private, permission-based blockchain

The bank group that aimed to leverage public blockchain for payments has decided to switch the underlying technology to private blockchain. The technology is built, and the banks are waiting for regulatory approvals to take it live.

* Credit loss provisions at US banks top $20B in Q4'22

Provisions for expected credit losses at U.S. banks increased for the seventh consecutive quarter in the last quarter of 2022, reaching $20.37 billion during the period.

* US asset management M&A deal count, value plummet in 2022

The number of U.S. asset management M&A deals was down to 171 in 2022 from 201 in 2021. The 2022 deals were valued at $2.45 billion, compared with $8.69 billion in 2021, according to S&P Global Market Intelligence data.

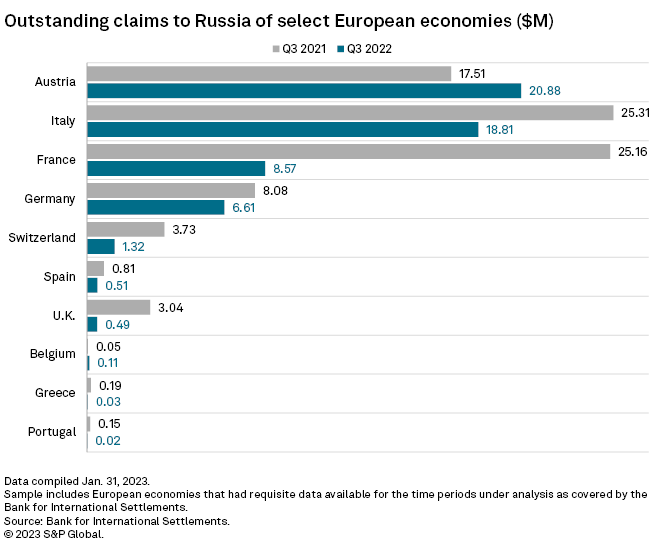

* Russia-Ukraine war splinters Europe's banking industry

Western banks' exposures to Russia are at their lowest level in nearly 20 years following the Ukraine invasion, while big Russian lenders have had to abandon key European markets amid a slew of western sanctions.

* Banks, funds on alert as Europe's enforcement of Russia sanctions ramps up

Financial institutions likely face greater scrutiny and further fines in the coming years as authorities shift focus from introducing new sanctions to more rigorously enforcing existing ones.

* War-linked loan loss provisions pummel Ukraine banks' 2022 profits

Ukrainian banks' net profit fell 68% in 2022, primarily driven by provisioning for incurred and expected losses connected to Russia's invasion of the country, Ukraine's central bank said.

* HSBC plans special dividend to appease disgruntled investors

Europe's largest bank by assets intends to pay a special dividend of 21 U.S. cents per share in early 2024, which would be the priority use of earnings from the disposal of HSBC Bank Canada.

Asia-Pacific

* Japanese megabanks' margins may abate decline on economic revival, credit growth

Japan's three megabanks may abate the decline in their net interest margins as efforts to revive economic growth could boost domestic credit demand.

* Indian banks' earnings momentum to sustain some more before rates start to bite

Indian banks will likely maintain their strong earnings momentum in the final quarter of the fiscal year to March 31 before rising interest rates start to drag on credit growth.

* China may keep IPO lead, helped by friendlier regulation and ample liquidity

China is set for another strong year for initial public offerings helped by a still-accommodative monetary policy and a regulatory push to make it easier for quality companies to access equity capital.

Global Insurance

* Latest entrant to annuity reinsurance market a product of P&C pivot

The majority owner of a reinsurer that has diversified its product appetite once touted the business of reinsuring runoff books of non-life risks as one characterized by "really limited competition" and "significant opportunity."

* Insurers unable to tally up true cost of Ukraine war

The political risk, aviation and marine markets are among the most affected business lines as the conflict heads into its second year.

* Axa cutbacks to be largely completed in 2023

The insurer is planning a further 35% reduction in its reinsurance business's catastrophe exposure, and will continue its push to exit unwanted in-force life business, executives said on an earnings call.

* Lemonade insurtech still on path to profitability after 2022 losses – executives

Lemonade Inc. President and co-CEO Shai Wininger said the insurtech has undertaken "broad efforts" to decrease its loss ratios, including stopping business with customers the company could not adequately price.

* Texas approves most impactful homeowners rate hikes in Q4'22

Regulators in Texas signed off on 32 rate hike requests during the last quarter of 2022, which may result in the largest calculated increase for any state.